Click here to view entire resolution

*This resolution was replaced by an updated version adopted November 14, 2017*

RESOLUTION NO. R-9-2017

RDA Tax Increment Reimbursement Program Policy October 10, 2017

RESOLUTION OF THE BOARD OF DIRECTORS OF THE REDEVELOPMENT AGENCY OF SALT LAKE CITY ADOPTING AN RDA TAX INCREMENT REIMBURSEMENT PROGRAM POLICY

WHEREAS, the Redevelopment Agency of Salt Lake City (“RDA”) was created to transact the business and exercise the powers provided for in the Utah Community Reinvestment Agency Act; and

WHEREAS, the Utah Community Reinvestment Agency Act grants the RDA authority to enter into participation agreements (also known as tax increment reimbursement agreements) with property owners within a project area, for the purpose of providing incentives in the form of tax increment to redevelop the property; and

WHEREAS, the RDA has a Tax Increment Reimbursement Program (“Program”), whose purpose is to provide reimbursement for certain upfront development costs related to projects in RDA Project Areas that meet the intent of the RDA’s project area plans or that achieve Salt Lake City’s economic development goals for business retention and expansion; and

WHEREAS, the Board of Directors (“Board”) intends to replace the Tax Increment Reimbursement Program Policy adopted on June 13, 2017 with the policy below; and

WHEREAS, the Board supports the goal to provide tax increment reimbursements through the Program pursuant to the process outlined below.

NOW, THEREFORE, BE IT RESOLVED BY THE BOARD OF DIRECTORS OF THE REDEVELOPMENT AGENCY OF SALT LAKE CITY, that we do hereby establish policy guidelines for the RDA Tax Increment Reimbursement Program to include the following:

9. GENERAL

1.1 Mission

The RDA Tax Increment Reimbursement Program (“Program”) may provide project developers a tax increment reimbursement (“Reimbursement”) for the development of improvements in an RDA project area that meet the goals and objectives of the RDA’s project area plans and provide significant public benefit, or for the development of improvements that achieve Salt Lake City’s economic development goals for business retention and expansion. The Program is designed to provide reimbursements that are calculated using Salt Lake County’s assessed value. The developer will receive a percentage of the tax increment generated from its project for a specified timeframe, and the RDA will receive the residual tax increment generated by the project.

1.2 Authorization

A Reimbursement shall only be given by the RDA pursuant to a Participation and Reimbursement Agreement (“Agreement”) approved by the Board. The Board shall reserve the right to deny a tax increment reimbursement application at any time for any reason. Any approval of an Agreement shall be made by resolution, which shall include the terms of the Agreement.

1.3 Reimbursement Categories

Only projects that are within the following baseline categories shall be initially eligible for Reimbursement:

a. Project Area Development.

Projects that are located within a previously established RDA project area that achieve the RDA’s project area development goals as defined in the project area plan.

b. Single Property Business Retention Tool.

Projects that are located within Salt Lake City’s municipal boundaries that achieve the City’s economic development goals for business retention and expansion. Projects shall only be eligible for Reimbursement if the RDA Board simultaneously authorizes creation of a property-specific RDA project area for the project.

1.4 Maximum Tax Increment Calculation

The formula to calculate the potential maximum total tax increment reimbursement generated from the proposed improvements shall be as follows:

e. Step 1: Calculate the Total Annual Tax Increment.

•The difference between the base taxable value of the proposed project prior to improvements and the estimated new growth in taxable value resulting from the improvements. (New Growth – Base Value).

•Multiplied by the current effective tax rate.

(New Growth – Base Value) x (Effective Tax Rate) = Total Annual TI.

f. Step 2: Calculate the Annual Tax Increment Collected by the RDA.

•Total Annual TI multiplied by the percentage of TI collected and retained from the taxing entities by the RDA. (Total Annual TI) x (% of TI collected by the RDA) = Annual TI Collected by the RDA.

g. Step 3: Calculate the 1st Year Developer Allocation.

•(Annual TI Collected by the RDA) x (Participation Rate) = Estimated Year 1 TI Reimbursement to Developer. Refer to Sections 2 and 4 for more information on calculating the participation rate between the RDA and the developer.

h. Step 4: Calculate the Maximum Amount of Tax Increment Available to the Developer Over the Term of the TI Reimbursement Agreement.

i. (Estimated Year 1 Tax Increment Reimbursement to Developer) x (the Term of the Reimbursement Agreement) = Total Developer Tax Increment Available Over the Term. An annual growth multiplier based on current economic conditions may be applied to this calculation.

The actual total of the tax increment reimbursement may fluctuate. Tax increment reimbursement is dependent on the increment being generated by the project, and projects that do not generate sufficient tax increment during the Reimbursement Term will not qualify for the full tax increment reimbursement amount.

1.5 Eligible Costs

The tax increment reimbursement will be limited to funding hard cost construction and site improvements. Use of funds for environmental remediation or demolition shall be considered on a case-by-case basis. The RDA may determine if the entire project or only specific project elements are eligible.

1.6 Design Requirements

Projects approved for tax increment reimbursement must consider the RDA’s Design Guidelines and utilize the guidelines as practicable. Projects will be required to be in conformance with all Salt Lake City policies, ordinances, and codes.

2. REQUIREMENTS AND STRUCTURE: PROJECT AREA DEVELOPMENT

2.1 Scope

Any Agreement authorized for a project that is in the Project Area Development category will meet the following requirements.

2.2 Threshold Requirements

Projects must meet the following requirements:

d. Projects shall achieve a minimum of: a) align with the RDA’s project area plan in the applicable RDA project area, and; b) meet at least one of the following Public Benefit criteria: Sustainability, Public Amenities, Adaptive Reuse, Historic Preservation, Permanent Job Creation/Retention, Architecture/Urban Design, Economic Impact, Affordable Housing.

e. The applicant must provide sufficient evidence that tax increment funding is necessary for the project to succeed and to verify that the request is reasonable.

f. The proposed project must involve significant private investment so as to assure adequate yield of tax increment.

2.3 Eligible Project Locations

Eligible projects shall be located in a tax increment collection area within an active RDA project area that allows tax increment reimbursements pursuant to the project area plan.

2.4 Maximum Reimbursement Term

The maximum reimbursement term shall be 10 years or the sum of the remaining operating years of a project area, whichever is less.

2.5 Participation Rate

Salt Lake City’s participation rate shall be determined by the number of years the applicable RDA project area is in operation at the time of project completion, and the number of Public Benefit Incentives the project qualifies for.

e. Projects Completed Years 1 through 5 from the Establishment of a Project Area.

For projects that are initiated and completed within the first five years of the date the project area was established, the standard participation rate shall be determined as follows:

i. 70% of the annual tax increment generated by the project and captured and retained by the RDA for years 1 through 5 of the Reimbursement Term.

ii. 50% of the annual tax increment generated by the project and captured and retained by the RDA for years 6 through 10 of the Reimbursement Term.

iii. Projects shall be eligible for up to a 20% increase for qualifying for Public Benefit Incentives.

f. Projects Completed 6 or More Years from the Establishment of a Project Area, but Excluding Five Years Prior to the Expiration of a Project Area.

For projects that are completed between year six of the date the project area was established and five years from the date that the project area will expire (i.e. years 6 through 20 of a project area with a 25-year life span), the standard participation rate shall be determined as follows:

i. 50% of the annual tax increment generated by the project and captured and retained by the RDA for the full Reimbursement Term.

ii. Projects shall be eligible for up to a 20% increase for qualifying for public benefit incentives.

g. Projects Completed Five Years Prior to the Expiration of a Project Area.

Projects completed within five years prior to the date of project area expiration are not eligible for tax increment reimbursement.

h. Public Benefit Incentives.

An increase to the standard participation rate shall be available if the project meets more than one of the following Public Benefit criteria: Sustainability, Public Amenities, Adaptive Reuse, Historic Preservation, Permanent Job Creation/Retention, Architecture/Urban Design, Economic Impact, and Affordable Housing. For each criterion fulfilled, beyond the initial Public Benefit Incentive required to meet the eligibility requirement to apply for a tax increment reimbursement, the project may receive a 5% increase from the standard participation rate, with a maximum increase of 20%.

|

Figure 1: Participation Rate Calculation Chart – Project Area Development | |||||

|

PROJECT AREA YEARS |

TERM MAXIMUM |

TERM INSTALLMENT |

PARTICIPATION RATE | ||

|

STANDARD |

PUBLIC BENEFIT INCREASE |

MAXIMUM TOTAL | |||

|

Project is completed within 1 - 5 years of establishing the project area |

10 Years |

1 - 5 Years |

70% |

Up to 20% |

90% |

|

5 - 10 Years |

50% |

Up to 20% |

70% | ||

|

Project is completed within 6 - 20 years of establishing the project area |

10 Years or the remaining term of the project area, whichever is less |

1 - 10 Years |

50% |

Up to 20% |

70% |

|

Project is completed within 21 - 25 years of establishing the project area |

Not eligible for tax increment reimbursement funding. | ||||

|

Note: Project Area Years are based on a project area with a 25-year operating period. | |||||

|

Note: A 5% increase to the standard reimbursement installment rate shall be available for each eligible Public Benefit criteria met by the project, for a maximum increase of 20%. | |||||

3. REQUIREMENTS AND STRUCTURE: SINGLE PROPERTY BUSINESS RETENTION TOOL

3.1 Scope

Any Agreement authorized for a project that is in the Single Property Business Retention Tool category will meet the following requirements.

3.2 Process

The RDA Board may create a single property owner Community Reinvestment Area (“Single Property CRA”) for an existing Salt Lake City property owner or business (“Local Business”) if the Local Business owner proposes a project that achieves the City’s economic development goals for business retention and expansion. Upon creation of the Single Property CRA, the Local Business may become eligible for tax increment reimbursement, as outlined in Section 3.4. The RDA shall seek the City’s participation as a taxing entity for the Single Property CRA, subject to the City Council’s approval, and the RDA may also seek participation in the Single Property CRA from non-City taxing entities. The RDA Board has the authority to create the Single Property CRA and approve the Agreement for Reimbursement simultaneously.

3.3 Annual Agreement Limit

The RDA may execute a maximum of four (4) Agreements for a project in the Single Property Business Retention Tool category within a single calendar year.

3.4 Threshold Requirements

The Local Business seeking a Single Property CRA and related Agreement must achieve the following threshold requirements to receive a tax increment reimbursement pursuant to this section:

f. The Local Business must commit to invest a minimum $12 million in private capital expenditures into the project.

g. The Local Business must demonstrate the project will result in job retention and/or job creation. One of the following job creation/retention standards must be achieved:

o The minimum creation of one (1) full-time equivalent permanent job (created or retained) per $50,000 of eligible tax increment.

o The creation or retention of jobs at an aggregate of 110% of the average Salt Lake County wage.

h. The Local Business must demonstrate that the tax increment reimbursement is necessary for the project to succeed.

i. The Local Business must demonstrate that it is an existing Salt Lake City-based business and the tax increment reimbursement will result in the business remaining or expanding in the City.

j. The project must employ sustainable construction practices consistent with a reputable sustainable building program approved by the Executive Director.

Once RDA staff has confirmed that the Local Business meets the threshold requirements for tax increment reimbursement listed above, the Local Business’ application for tax increment reimbursement will be reviewed and finalized pursuant to this policy.

3.5 Maximum Reimbursement Term

The maximum reimbursement term shall be 25 years for Agreements eligible under the Single Property Business Retention Tool category.

3.6 Participation Rate

Salt Lake City’s maximum participation rate shall be determined by the level of economic and public benefit provided by the project. The standard rate shall be 70% and the maximum shall be 90%, as follows.

a. Standard.

The standard participation rate for Agreements eligible under Single Property Business Retention Tool shall be 70% of the annual tax increment generated by the project and statutorily captured and retained by the RDA for economic development.

b. Economic and Public Benefit Incentives.

An increase from the standard participation rate, as defined in 3.6(a), may be obtained if the project meets certain economic and public benefit criteria. For each of the following criterion fulfilled, the project may be eligible for a 5% increase in the participation rate, for a maximum of a 20% increase: Sustainability, Public Amenities, Adaptive Reuse, Historic Preservation, Significant Job Creation, Significant Wage Generation, Significant Economic Impact, Architecture/Urban Design, and Unique Construction or Tenant Improvements.

Figure 2: Participation Rate Calculation Chart – Single Property Business Retention Tool

|

STANDARD |

ECONOMIC/PUBLIC BENEFIT INCREASE |

MAXIMUM TOTAL |

|

70% |

Up to 20% |

90% |

4. EVALUATION AND APPROVAL PROCESS

4.1 Scope

An Agreement eligible under the Project Area Development category will be evaluated and processed as described in Section 4.2. An Agreement eligible under the Single Property Business Retention Tool category will be evaluated and processed as described in Section 4.3.

4.2 Project Area Development

a. Step 1: Application Processing and RDA Staff Review.

All applications shall be made to RDA staff, on standard RDA forms. All applications must be complete to be evaluated, and if either the applicant or proposed project fails to demonstrate the ability to meet application requirements, RDA staff may deny the application.

b. Step 2: RDA Finance Committee Review.

RDA staff shall forward complete applications that meet minimum requirements to the RDA Finance Committee. The RDA Finance Committee shall evaluate applications, supplemental materials, and other documentation necessary to thoroughly review the application and formulate a recommendation to the Board.

c. Step 3: Adoption of the Tax Increment Reimbursement Agreement Terms.

Upon review of the application and supporting material, the Board shall consider for approval a resolution that approves the Agreement terms.

d. Step 4: Agreement Finalization.

Once the terms of an agreement have been authorized by the Board, the RDA and developer shall execute an Agreement.

4.3 Single Property Retention Tool

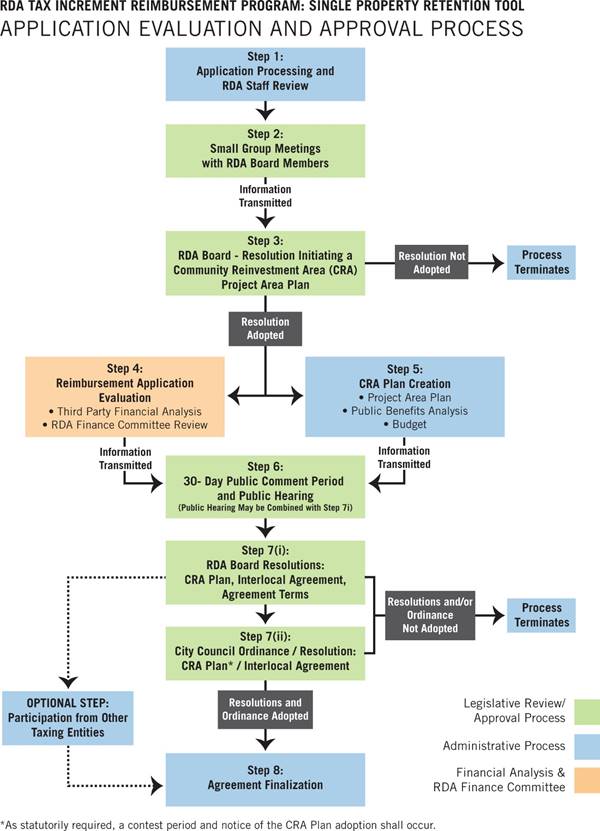

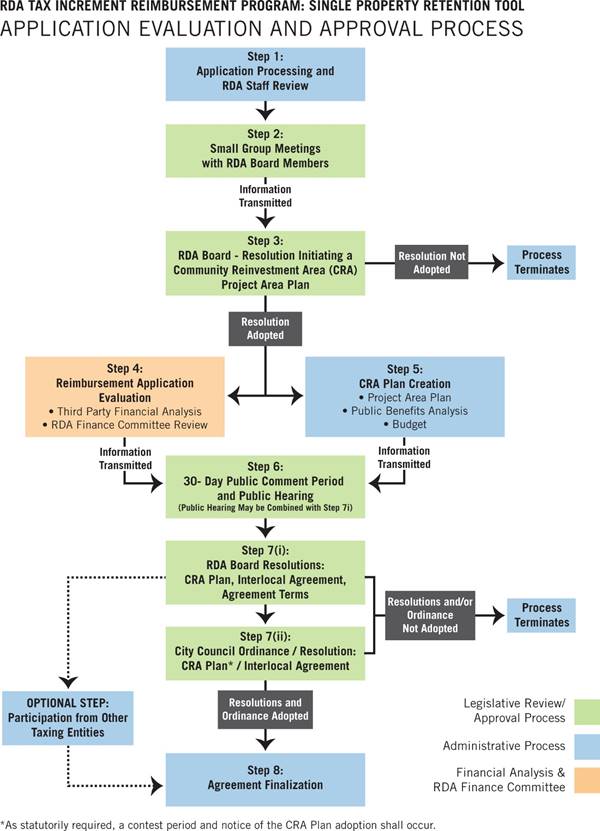

Refer to Appendix A for a visual representation of the Single Property Retention Tool evaluation and approval process.

a. Step 1: Application Processing and RDA Staff Review.

All applications shall be made to RDA staff, on standard RDA forms. All applications must be complete to be evaluated, and if either the applicant or proposed project fails to demonstrate the ability to meet application requirements, RDA staff may deny the application.

b. Step 2: Small Group Meetings.

If the proposed application meets the RDA staff’s initial evaluation criteria, RDA staff will schedule small group meetings with the Board to provide Board members with an overview of the proposed project and anticipated economic and public benefits. If Board members are generally supportive of the proposed project, the Board will schedule a public meeting to discuss the proposed project pursuant to Step 3.

c. Step 3: Initiation of a Community Reinvestment Project Area Plan.

Upon presentation of the general overview of the proposed project in a public meeting, the Board may adopt a resolution initiating a community reinvestment project area plan (“CRA Plan”). The resolution shall designate the geographical area, and authorize the RDA to conduct the required analysis under Utah Code 17C to create a project area. If the Board does not adopt a resolution, the application shall be deemed disapproved.

d. Step 4: Reimbursement Application Evaluation.

The RDA shall carry out the following to evaluate the Reimbursement application.

i. Third Party Financial Analysis.

RDA staff shall consult with a third party financial analyst to provide a recommendation on 1) the public benefit anticipated to be derived from the proposed project and 2) determination of financial need and whether or not the proposed project might reasonably occur through private investment without the Reimbursement. The third-party financial analysis shall be provided to the Board prior to the Board’s consideration of the Reimbursement application.

ii. RDA Finance Committee Review.

RDA staff shall, after receiving the third party analysis on financial feasibility referenced above, forward the complete application that meets minimum requirements and the financial feasibility analysis to the RDA Finance Committee. The RDA Finance Committee shall evaluate the application, supplemental materials, and other documentation necessary to thoroughly review the application in accordance with the policy contained herewith and formulate a recommendation to the Board. The RDA Finance Committee shall provide a recommendation of approval or denial of all applications to the Board for consideration.

e. Step 5: CRA Plan Creation.

RDA staff shall draft the required components of the CRA Plan, including a description of project area boundaries, project area activities, conformance with the general plan, anticipated public benefits, and the project area budget.

f. Step 6: Public Comment Period and Public Hearing.

RDA staff shall transmit all relevant information to the Board, including an overview of the project, description of the proposed benefits to the local economy, proposed increase in assessed property values, and any potential concerns of the project. Upon receipt of the transmittal, the RDA Board may schedule a public comment period and hearing as follows and as required under Utah Code 17C:

i. Public Comment Period.

Thirty-days prior to holding a public hearing, the RDA Board shall have the CRA Plan available to the public.

ii. Public Hearing.

The Board shall hold a public hearing to allow public comment on the proposed CRA Plan and whether the RDA should revise, approve, or reject the plan.

g. Step 7: Adoption of the CRA Plan and Agreement Terms.

i. Board.

Either simultaneously or in separate public meetings, the Board may consider as part of the Board’s consideration of the Agreement the following resolutions: 1) a resolution that approves the CRA Plan, 2) a resolution authorizing an interlocal agreement to facilitate the receipt of project area funds by the RDA, and 3) a resolution that approves the Agreement. If the Board does not adopt one or more of these resolutions, the application shall be deemed disapproved.

In addition, if non-City taxing entities will be participating in the Single Property CRA, the Board shall consider a resolution authorizing an interlocal agreement to facilitate the receipt of project area funds from the taxing entity that is participating.

As statutorily required, a contest period and notice of the CRA Plan adoption shall occur.

ii. City Council.

The City Council may consider for approval an ordinance that approves the community reinvestment project area plan. In addition, the City Council may consider for approval a resolution authorizing an interlocal agreement to facilitate the receipt of project area funds by the RDA. If the City Council does not adopt the ordinance and/or resolution, the application shall be deemed disapproved.

h. Step 8: Agreement Finalization.

Once the terms of an agreement have been authorized by the Board, the RDA and developer shall execute an Agreement.

5. AGREEMENT TERMS

5.1 Participation and Reimbursement Agreement Terms

In addition to standard terms outlining the tax increment reimbursement process as recommended by legal counsel, the following terms shall be included in the Agreement:

c. Reimbursement to Benefit Project Owner: RDA Discretion.

The RDA intends that the beneficiary of the tax increment reimbursement will be the owner of the project for the life of the Agreement. In the event of a transfer or sale of the property, the Agreement and all benefits conferred under the Agreement shall benefit the project and be recorded against the property to run with the land, with the intent that all tax increment reimbursements will remain with the owner of the real property and project. In the event that the ownership of the real property and improvements are severed, the RDA will have sole discretion to determine the beneficiary of the tax increment.

If the Agreement is executed and the real property and project are conveyed to a third party while the improvements are still being constructed, the RDA will retain the right to consent to the transfer the Agreement to the new owner, in order to ensure that the benefits the RDA anticipated receiving under the original Agreement with the original developer are consistent with the new developer. If RDA does not consent to the transfer of the Agreement, the tax increment reimbursement will cease and the Agreement will terminate.

d. Tax Appeals.

All reimbursement recipients shall be required to notify the RDA if they have applied for a property tax appeal with Salt Lake County related to the tax increment reimbursement. In the event that any such appeal results in a reduction in property taxes, the percentage share of the tax increment payable to the recipient shall be decreased, and the percentage share of the tax increment payable to the RDA shall be increased, so that the dollar amount payable to the RDA is the same as if no appeal of the assessed value had been made.

e. Recapture Provisions in the Event of Default.

Agreements shall require the recapture of all or a portion of tax increment reimbursement funds allocated to a project that fails to meet its economic or public benefit requirements as provided in the Agreement.

f. Participant Reporting Requirements.

Agreements shall require reporting from reimbursement recipients as per the following:

i. Project Completion: Upon project completion, reimbursement recipients shall provide a report that includes the total cost of improvements, a summary of completed improvements, and outcome metrics relating to project-specific requirements as per the Agreement.

ii. Annual Pre-Reimbursement: Contingent upon receiving an annual reimbursement, reimbursement recipients shall provide a report that includes notification of any tax appeals and outcome metrics relating to project-specific requirements as per the Agreement. As applicable, the report shall include relevant data that is certified by a financial officer or public accountant.

5.2 Interest

Interest will not accrue against the RDA on the anticipated or projected tax increment to be reimbursed to the developer.

6. REPORTING AND COMMUNICATIONS

6.1 Reporting

The RDA shall provide a written briefing to the Board, no less than annually per fiscal year, which contains an update on the RDA’s Reimbursement portfolio. Such briefing shall include a summary of new Agreements, anticipated budget impacts, and project metrics.

6.2 Communications

For each Agreement entered into as facilitated through the Single Property Business Retention Tool, an informational sheet, that summarizes the project and anticipated economic and public benefits, shall be created and made available to the public.

Appendix A:

Passed by the Board of Directors of the Redevelopment Agency of Salt Lake City, this 10th day of October, 2017.